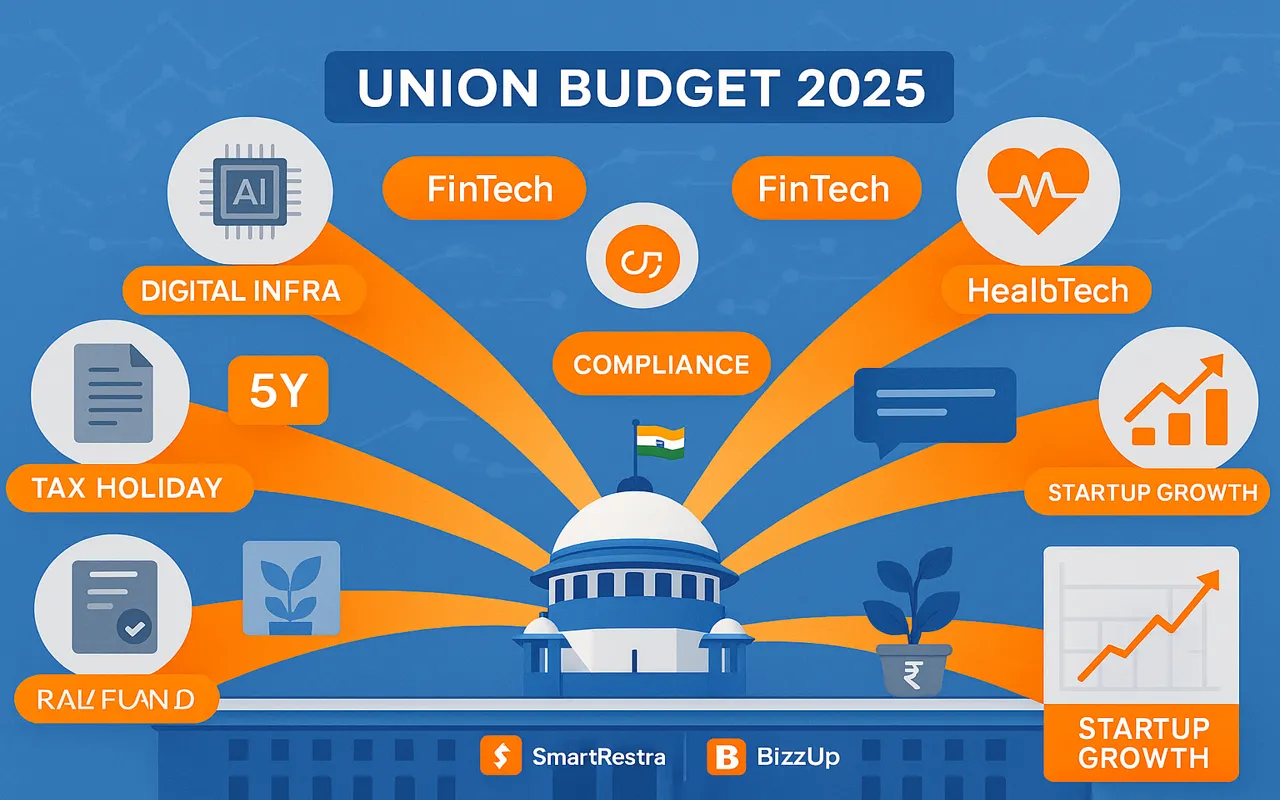

Union Budget 2025: What Indian Startups Must Know

The Union Budget 2025 has brought significant changes for India's startup ecosystem. As a tech entrepreneur running ALS Startinnovate Private Limited, here's your actionable breakdown of policies affecting SaaS businesses like SmartRestra, MiniWebOnline, and BizzUp. Startups incorporated before March 2027 now enjoy 100% tax deduction for first 5 years (from previous 3 years). Perfect timing for our new SaaS products in development. Threshold increased to ₹50 crore valuation (from ₹25 crore) for exemption from angel tax scrutiny. Great news for BizzUp's upcoming funding rounds. Single-window clearance for startup licenses reduced to 14 days GST threshold for SaaS raised to ₹50 lakh (from ₹20 lakh) ESOP taxation deferred until actual sale of shares Need help adapting your SaaS business to Budget 2025 changes? Our startup consultants can create a customized tax-optimized roadmap for your digital products.1. Tax Incentives & Funding Boost

✔ Extended Tax Holiday

✔ Angel Tax Relief

2. Digital Infrastructure Push

3. Compliance Simplified

4. Sector-Specific Opportunities

5. Action Plan for ALS Startinnovate

0 comment on “Union Budget 2025: What Indian Startups Must Know”

Leave a Reply

Your email address will not be published.

Ready to build your dream product?

Whether it’s a sleek mobile app or a full-stack platform, our experts are here to help.